The US plastics industry is one of the US economy’s largest and fastest growing industries that has made strong recovery after the global recession in 2008 – 2009. Today, there are over 16,000 plastics facilities in the U.S. in all 50 states, the industry employs more than 1.7 million people and achieved a record of $583.7 billion in shipments in 2015, reported by the Society of the Plastics Industry. Plastics shipments in the US have seen 11.5% since 2012, making it the third largest manufacturing sector in the US behind the petroleum and automotive industries and ahead of basic chemicals. Due to growing competition, businesses are using networking websites like BizHub’s Plastics industry section to find quality business partners. So whether you are looking for importers, exporters or manufactures there is a place for you to start on BizHub.

Key Facts – the US Plastics Industry Overview

- The plastics industry is 3rd largest manufacturing sector in the US, accounting for 940,000 jobs and $427.3 billion in shipments during 2014.

- Texas employs the most people in the plastics industry. As a percentage of total non-farm employment, the plastics industry is most important to Indiana, where it accounts for 16.4 of every 1,000 non-farm jobs. Michigan is a close second.

- Including suppliers to the plastics industry, jobs grow to 1.7 million, and total shipments grow to $583.7 billion in 2015.

- The plastic products portion of the plastics industry was the 8th largest U.S. industry in 2013.

- The plastic materials and synthetics portion of the plastics industry (including rubber and fiber) was the 17th largest industry in 2013.

- A success story for the U.S. economy, plastics manufacturing employment grew 0.3 % per year from 1980 to 2014. This is compared with manufacturing as a whole, which saw employment shrink 1.3 % per year during those same years.

- The growth in plastics manufacturing employment slowed between 1995 and 2000 declined between 2000 and 2010, and then began growing again in 2011.

- Real plastics manufacturing shipments grew at a 2.6 % annual rate from 1980 to 2014, while real value added grew 2.3 % annually.

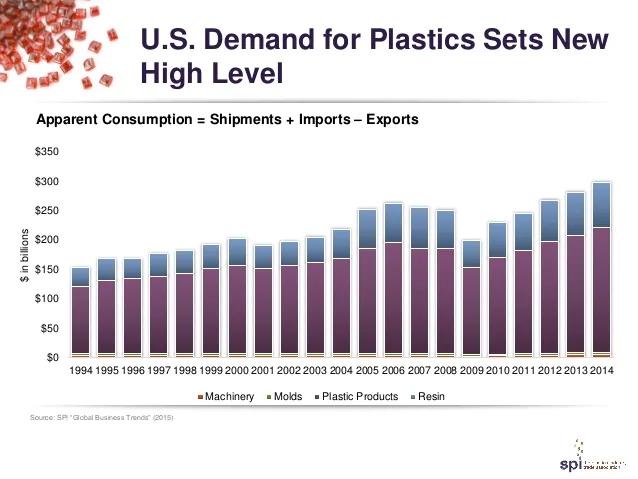

- Acceleration in the plastics industry reflects recovery from the recession and long-term trend growth.

- Although manufacturing is still the main outlet for plastics, an increasing share of plastics is going into services, including: Wholesale and Retail Trade; Finance, Insurance and Real Estate; and Healthcare.

The Global Trade of the US Plastics Industry

The U.S. plastics industry is a major participant in world trade. The country’s deficit in plastic products increased from $6.1 billion in 2013 to $6.8 billion in 2014, up by 12.1% — mostly because of the improving economy in the U.S. compared to the rest of the world. Other key facts about imports and exports of the US Plastics Industry include:

- Exports of plastic products increased by 5.1%, while imports grew 6.6%

- The U.S. had its largest plastic products surplus with Mexico, at $4.0 billion.

- China accounted for the largest plastic products trade deficit, at $11.5 billion, increased by 5.9 % from 2013.

- Exports of plastic products accounted for 12.1% of domestic shipments, and imports were 15.4 %.

- The consumption of plastic products grew by 6.6 %, from $199.7 billion in 2013 to $212.9 billion in 2014. As measured by the Producer Price Index, domestic

- plastic products rose 1.7 % in 2014, suggesting that apparent consumption growth was 4.9 % in real terms.

- S. producers of plastic products represented 85.1 % in total market share of apparent consumption, the same as 2013.

- The estimated value of plastic products contained in exports recorded $27.6 billion, and the estimated value contained in imports was $50.4 billion, giving the US a $22.8 billion deficit in contained plastic products trade.

Driving the export increase was the mold market, with a 4.5% improvement in its trade deficit at $1.1 billion for 2014. The U.S. plastics machinery industry also reduced its deficit, registering a $1.2 billion trade deficit in 2014, which was a 5.2 % decrease on the year.

Major Trading Partners of US Plastics Industry

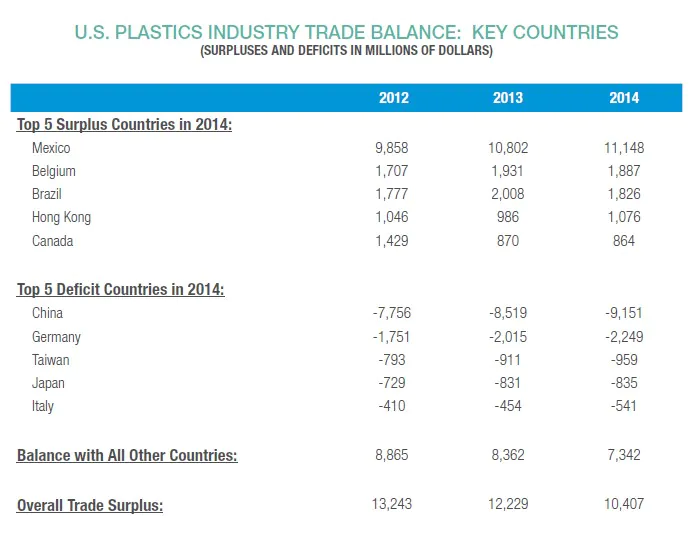

Mexico and Canada remain as the U.S. plastics industry’s largest export markets with $15.8 billion and $13.2 billion worth of exports, respectively, according to SPI’s 2015 Global Business Trends report. China is the third largest export market for the US plastics industry, though overall, the U.S. had its largest trade deficit with China at $9.2 billion in 2014.

In 2014, the top 5 US’ trading partners with the biggest plastics trading surplus are Mexico ($11.1 billion in surpluses), Belgium ($1.9 billion surpluses), Brazil ($1.9 billion surpluses), Hong Kong ($1.1 billion surpluses), Canada ($0.9 billion surpluses).

Meanwhile the top 5 trading partners with the largest plastics trading deficit in 2014 are China ($9.2 billion in deficit), Germany ($2.2 billion deficit), Taiwan ($1 billion deficit), Japan ($0.8 billion deficit), Italy ($0.5 billion deficit).

Future Prospects for Plastics Industry in the US

The plastics industry in the US as well as the worldwide plastics market are both expected to continue booming over the next few years, driven mainly by growing usage in transportation, healthcare and packaging end markets, according to SPI. The low cost of natural gas and oil in the U.S. compared to other regions, has driven down the cost of doing business in the United States for the plastics industry, making the US a more competitive player in the global plastics market.

The US’ plastics’ trade balance is expected to perform better in near future with more trade agreements. The passage of the Trans-Pacific Partnership (TPP) in the U.S. Congress would also further improve those positions and trade balances.